According to the Global Competitiveness Report (2014-2015) of World Economic Forum (WEF), Canada is ranked 15th out of 144 countries in its annual world competitiveness index, which means the country has slipped a bit further down the rankings of the world’s most competitive economies. It was Canada’s lowest ranking since 2006 on the index.

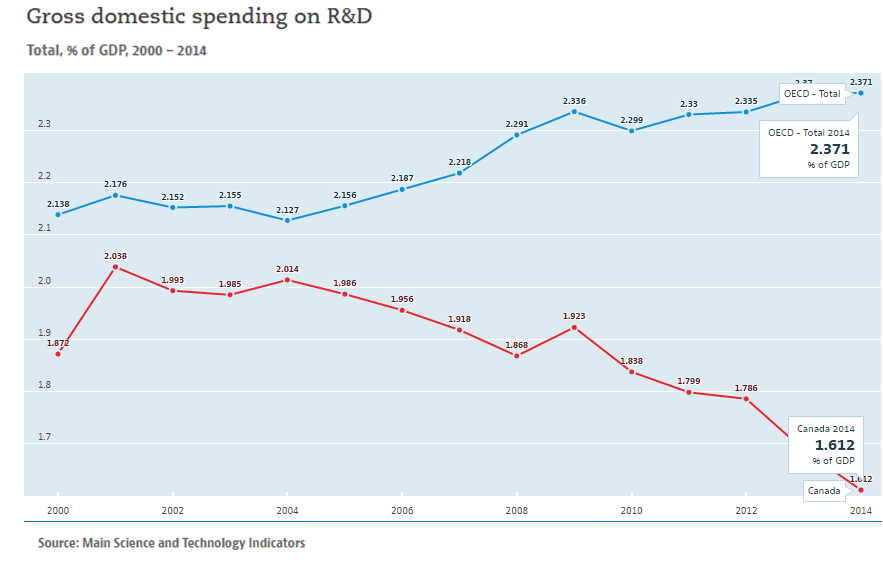

While the other countries as a whole continue to increase their gross expenditures on research and development (GERD), Canada is moving in the opposite direction.

The rate of total domestic spending on R&D in Canada has been in steady decline for more than a decade and stands at 1.61% of GDP in 2014, which is well below the OECD average of 2.37%.

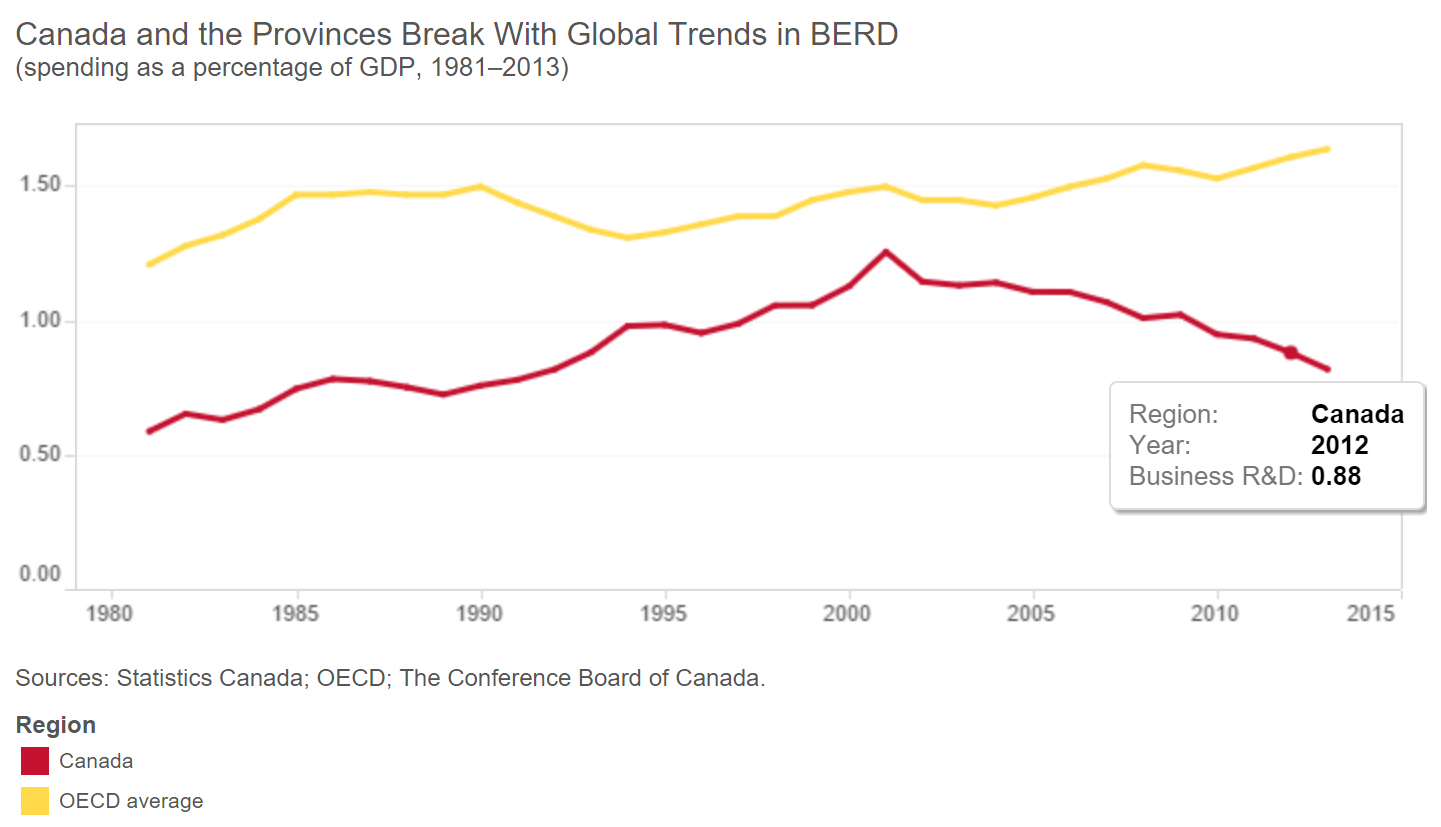

More disappointingly, the Business enterprise expenditure on R&D (BERD covers R&D activates carried out in the business by performing firms and institutes, regardless of the origin of funding), serving as an important indicator of business commitment to innovation, has decreased steadily from 1.26% of GDP in 2001 to 0.88% in 2012, well below the OECD median.

This occurred despite the generous Scientific Research and Experimental Development (SR&ED) tax incentive, which amounted to CAD 3.6 billion in 2012 and to 80% of overall public support for business R&D.

In short, although Canada increased its investments in R&D for most of the past 15 years, all the efforts the government did for improving R&D fall short of what many other countries are doing, condemning Canada to falling even further behind in the global science and technology race.

Structurally, Canada is not innovating as strongly as it should be, and is not really mobilizing to become more competitive.

Given all this, what’s required now is a deliberate approach: strategic, sensible policy changes that will spur investment in SMBs and promote business innovation.

Vijay Kalra CPA, CA and the CEO of SR&ED Funding Consultants Inc. suggests that “the government needs to modernize its policy for research and development. Programs such as the Scientific Research & Experimental Development (SRED) tax credit are critical to many businesses across the country.”

“The government should consider loosening the criteria for Scientific Research and Experimental Development (SR&ED), such as expanding the scope of qualified R&D, simplifying/reducing the amount of documentation work, to give smaller firms and start-ups greater access. In 2012, SR&ED was modified and one of the modifications was to stop allowing capital expenditure on SR&ED projects. This was a major setback and this allowance should be restored or compensated through higher allowance on salaries and other direct costs incurred during SR&ED projects.”

He goes on to say, “In view of dramatic collapse in the commodity sector particularly as relates to crude oil, it is essential that the Canadian government rethinks and revitalizes its policy towards advancing technology sector by spurring innovation through expansion of programs like SR&ED. This will provide a hedge against commodity based economy.”

Leave A Comment